- This is PANASIA

- Business locations

- ESG Management

- History

- Smart PANASIA

About

About

Check PANASIA introduction,

ESG management, and History

information

- Energy Solutions

- Air Solutions

- Water Solutions

Eco-friendly Solution

Eco-friendly Solution

About Global environmental

regulation, Hydrogen business,

Air quality, and Water quality

environment solutions

- Product Service

- Service Network

- Customer Service

Customer Support

Customer Support

Check the Panasia’s

after service

- About

- Eco-friendly Solution

- Customer Support

- Media

NEWS

Demand and Trends for Global LNG Carriers

The demand for liquefied natural gas (LNG) ships is steadily increasing worldwide, driven by a growing recognition of LNG as a more clean energy fuel. Many ship owners are implementing new energy conversion policies to replace conventional fuel with LNG, and as a result, the demand for LNG carriers is increasing. Additionally, the global LNG market has seen an increase in demand for both new LNG production facilities and LNG demand in recent years, which has further increased demand for new LNG carriers. Furthermore, the increased use of LNG fuel in various fields, including cargo transportation, is also contributing to the rise in demand for LNG ships, making the LNG carrier market expected to continue growing.

■ Reasons for the Increase in Demand for LNG Carriers

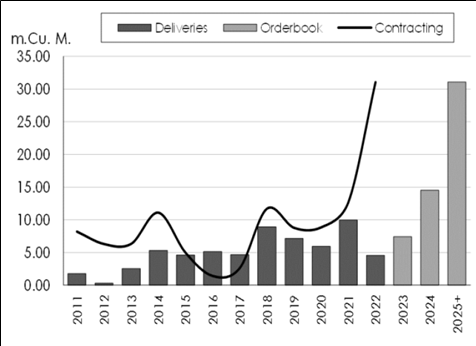

- Increase in LNG carrier orders: In the early 2000s, the discovery of shale gas led to an increase in LNG production, mainly in the US. The order volume for LNG carriers increased from 2004, but sharply decreased after the Lehman Brothers bankruptcy in 2008.

- Since 2011, the order volume has been increasing again, with a decline in 2016-2017 due to the downturn in the shipping industry. However, the implementation of IMO sulfur regulations in 2018 led to a new increase in orders.

< LNG Carrier Orders and Backlog >

Source: Clarksons Research

- The cargo capacity of LNG carriers is expected to increase by 4.6% in 2023.

- As of September 2022, 121 LNG carrier orders have been placed, exceeding the total orders from the previous year. An additional 25 orders are expected, in addition to the 44 ordered for the North Field (Qatar LNG Project).

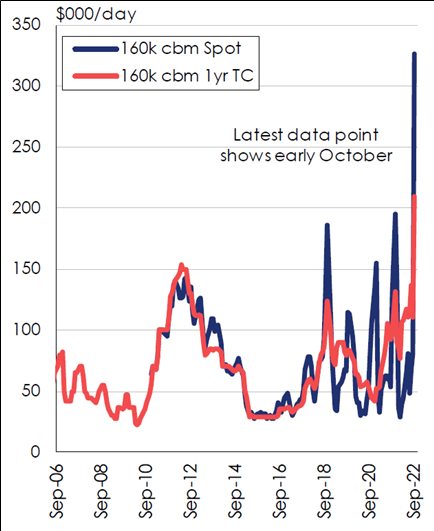

■ LNG Carriers shipping rates

- The long-term time charter rate for a 160K CBM DFDE vessel in 2022 was set at $110,000/day, a 25% increase from the previous year, and the highest average rate since 2012.

- The short-term time charter rate for a 160K CBM DFDE vessel in September 2022 was $55,868/day on average, a 17% decrease from the past, but remained solid.

- The rate decreased sharply in Q1 2022, but increased up to $97,500/day in June. It dropped to $41,750/day in July and increased up to $300,000/day in October.

< LNG Carrier Long-term/Short-term Time Charter Rates >

Source: Clarksons Research

■ Medium to long-term sustained growth

- Continuous growth in the medium to short term: LNG demand increased by 5.3% in 2022 compared to 2021. Due to the Russia-Ukraine crisis, gas transportation from Russia to Europe decreased sharply, but a 10% increase in demand is expected in 2023 compared to 2022. In Asia, a 4% decrease in demand is expected in 2023 due to recent increases in natural gas prices.

- A 3.8% increase is expected in global LNG trade in 2023, with an increase of 416 MT compared to the previous year.

- Continued growth at an average annual rate of 5.8% is expected until 2030.

■ LNG carriers are expected to transform the existing shipbuilding industry in various ways.

Firstly, LNG carriers have different technical requirements compared to traditional ships, and special safety measures are required when storing and transporting them due to LNG being liquefied natural gas. Therefore, the design and production methods of LNG carriers are different from traditional ships, which means that the technology and production lines of the shipbuilding industry must adapt to these changes.

Secondly, the increased demand for LNG carriers has a significant impact on the shipbuilding industry, with short waiting periods for orders and significant order sizes positively impacting shipbuilders' profitability. As a result, existing shipbuilders are entering the LNG shipbuilding market, which is expected to change the structure of the shipbuilding industry.

Thirdly, the use of LNG carriers is becoming more diverse, with LNG being used not only as a power generation source but also as an energy source for LNG carriers themselves, pioneering new markets. Therefore, the existing shipbuilding industry can grow not only in LNG shipbuilding but also in various fields such as the development of new technologies such as LNG fuel systems.

In conclusion, LNG carriers are one of the important factors that are changing the existing shipbuilding industry. Shipbuilders must respond actively to these changes and adapt to the new needs of the industry.